美国亚利桑那州坦佩。——2022年1月4日——经济活动in the manufacturing sector grew in December, with the overall economy achieving a 19th consecutive month of growth, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee:

“The December Manufacturing PMI registered 58.7 percent, a decrease of 2.4 percentage points from the November reading of 61.1 percent. This figure indicates expansion in the overall economy for the 19th month in a row after a contraction in April 2020. The New Orders Index registered 60.4 percent, down 1.1 percentage points compared to the November reading of 61.5 percent. The Production Index registered 59.2 percent, a decrease of 2.3 percentage points compared to the November reading of 61.5 percent. The Prices Index registered 68.2 percent, down 14.2 percentage points compared to the November figure of 82.4 percent. The Backlog of Orders Index registered 62.8 percent, 0.9 percentage point higher than the November reading of 61.9 percent. The Employment Index registered 54.2 percent, 0.9 percentage point higher compared to the November reading of 53.3 percent. The Supplier Deliveries Index registered 64.9 percent, down 7.3 percentage points from the November figure of 72.2 percent. The Inventories Index registered 54.7 percent, 2.1 percentage points lower than the November reading of 56.8 percent. The New Export Orders Index registered 53.6 percent, a decrease of 0.4 percentage point compared to the November reading of 54 percent. The Imports Index registered 53.8 percent, a 1.2-percentage point increase from the November reading of 52.6 percent.”

Fiore continued: “The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment, with indications of improvements in labor resources and supplier delivery performance. Shortages of critical lowest-tier materials, high commodity prices and difficulties in transporting products continue to plague reliable consumption. Coronavirus pandemic-related global issues — worker absenteeism, short-term shutdowns due to parts shortages, employee turnover and overseas supply chain problems — continue to impact manufacturing. However, panel sentiment remains strongly optimistic, with six positive growth comments for every cautious comment, down slightly from November. The forecast released this month indicates a strong 2022 performance expectation in terms of revenue growth and profitability. Demand expanded, with the (1) New Orders Index growing, supported by continued expansion of new export orders, (2) Customers’ Inventories Index remaining at a very low level and (3) Backlog of Orders Index staying at a very high level. Consumption (measured by the Production and Employment indexes) grew during the period, with a combined negative 1.4-percentage point change to the Manufacturing PMI® calculation. The Employment Index expanded for a fourth straight month, with some indications that ability to hire is improving, though somewhat offset by the continued challenges of turnover and backfilling. Inputs — expressed as supplier deliveries, inventories, and imports — continued to constrain production expansion, but there are clear signs of improved delivery performance. The Supplier Deliveries Index again slowed while the Inventories Index expanded, both at a slower rate. In December, the Prices Index increased for the 19th consecutive month, at a slower rate (a decrease of 14.2 percentage points), indicating that supplier pricing power continues to rise, but to a lesser degree.

“所有六个最大的制造业 - 化学产品;制造的金属产品;计算机和电子产品;食品,饮料和烟草产品;运输设备;以及石油和煤炭产品,按该顺序 - 在12月注册的中度至短期增长。

“Manufacturing performed well for the 19th straight month, with demand and consumption registering month-over-month growth. Meeting demand will remain a challenge, due to hiring difficulties and a clear cycle of labor turnover at all tiers. For the second month in a row, Business Survey Committee panelists’ comments suggest month-over-month improvement on hiring, offset by backfilling required to address employee turnover. Supplier delivery rate improvement was indicated by the Supplier Deliveries Index softening in December. Transportation networks, a harbinger of future supplier delivery performance, are still performing erratically; however, there are signs of improvement,” says Fiore.

The 15 manufacturing industries reporting growth in December — in the following order — are: Apparel, Leather & Allied Products; Furniture & Related Products; Textile Mills; Plastics & Rubber Products; Machinery; Nonmetallic Mineral Products; Miscellaneous Manufacturing; Chemical Products; Electrical Equipment, Appliances & Components; Fabricated Metal Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Transportation Equipment; Primary Metals; and Petroleum & Coal Products. The three industries reporting a decrease in December compared to November are: Wood Products; Printing & Related Support Activities; and Paper Products.

What Respondents Are Saying

“Chemical supply chains are filling very slowly. Still not full, but (my) gut feeling says it’s getting easier to source chemical raw materials.” [Chemical Products]

“Continued strong demand has our production facilities producing as many vehicles as we have materials for; however, capacity is limited due to the global chip shortage.” [Transportation Equipment]

“由于()Omicron变体引起的石油价格降低引起了人们对2022年生产和资本支出的关注。”[石油和煤炭产品]

“劳动仍然很紧,营业额仍在继续。供应链问题仍在导致削减客户订单。卡车很少,团队被烧毁了长时间的工作,每天处理供应限制。”[食品,饮料和烟草产品]

“Price increases appear to be slowing. Lead times are shrinking slowly, and inventories are growing. I hope we have reached the top of the hill to start down a gentle slope that lets us get back to something that resembles normal.” [Fabricated Metal Products]

“Business continues to be good, with strong incoming orders from customers. Continue to battle labor, material and transportation pressures.” [Furniture & Related Products]

“Construction projects for 2022 and 2023 look very strong for us.” [Nonmetallic Mineral Products]

“Costs for steel seem to be coming down some. We have seen a little relief on steel prices, but they are still very high. Overall performance by suppliers has improved. On-time deliveries have improved.” [Machinery]

“在第四季度,供应链中断急剧增加。我们的许多供应商直到2022年1月或更晚才能交付产品。”[其他制造]

“Very robust order activity. Backlog increased. Plastic raw material shortages impact orders.” [Plastics & Rubber Products]

| MANUFACTURING AT A GLANCE 2021年12月 |

||||||

| 我ndex | SeriesIndexDec | Series IndexNov | 百分比 观点 Change |

Direction | Rate of Change | Trend* (Months) |

| 制造业 PMI® |

58.7 | 61.1 | -2.4 | 生长 | Slower | 19 |

| New Orders | 60.4 | 61.5 | -1.1 | 生长 | Slower | 19 |

| Production | 59.2 | 61.5 | -2.3 | 生长 | Slower | 19 |

| Employment | 54.2 | 53.3 | +0.9 | 生长 | Faster | 4 |

| 供应商 Deliveries |

64.9 | 72.2 | -7.3 | Slowing | Slower | 70 |

| 库存 | 54.7 | 56.8 | -2.1 | 生长 | Slower | 5 |

| 顾客' 库存 |

31.7 | 25.1 | +6.6 | 太低 | Slower | 63 |

| 价格 | 68.2 | 82.4 | -14.2 | 我ncreasing | Slower | 19 |

| Backlog of 订单 |

62.8 | 61.9 | +0.9 | 生长 | Faster | 18 |

| 新出口 订单 |

53.6 | 54.0 | -0.4 | 生长 | Slower | 18 |

| 我mports | 53.8 | 52.6 | +1.2 | 生长 | Faster | 2 |

| 整体经济 | 生长 | Slower | 19 | |||

| 制造业Sector | 生长 | Slower | 19 | |||

制造业我SM® Report On Business® data is seasonally adjusted for the New Orders, Production, Employment and Inventories indexes.

*朝着当前方向移动的月数。

Commodities Reported Up/Down In Price and In Short Supply

Commodities Up in Price Adhesives and Paint; Aluminum* (19); Capacitors; Corrugate (15); Corrugated Packaging (14); Diesel Fuel (12); Electrical Components (13); Electronic Components (13); Freight (14); Labor — Services; Labor — Temporary (8); Logistics Services; Lubricants; Lumber; Natural Gas* (6); Nylon (3); Ocean Freight (13); Packaging Supplies (13); Printed Circuit Boards (PCBs); Resin Based Products (11); Resistors; Rubber Based Products (5); Semiconductors (11); Silicone (2); Steel* (17); Steel — Galvanized; Steel — Stainless (14); and Steel Products* (16).

Commodities Down in Price Aluminum* (2); Crude Oil; Ethylene; Natural Gas*; Polyethylene; Propylene; Steel* (2); and Steel — Hot Rolled (2).

短供应金中的商品(2);铜产品;电缆;电气组件(15);电子组件(13);劳动 - 临时(8);塑料树脂 - 其他(10);基于橡胶的产品;半导体(13);和钢(13)。

Note: The number of consecutive months the commodity has been listed is indicated after each item.

*表示这些商品的价格上涨。

2021年12月制造业我ndex Summaries

制造业PMI®

制造业在12月增长,因为制造业PMI的占58.7%,比11.1%的61.1%的读数低2.4个百分点。“制造业PMI继续表明12月的强劲扩张和美国经济增长。直接将PMI的所有五个子索引都处于生长领域。所有六个最大的制造行业都按以下顺序扩展:化学产品;制造的金属产品;计算机和电子产品;食品,饮料和烟草产品;运输设备;以及石油和煤炭产品。新的订单和生产指数保持较强。 The Supplier Deliveries Index softened but continued to reflect suppliers’ difficulties in maintaining delivery rates. All 10 of the subindexes were positive for the period; a reading of ‘too low’ for the Customers’ Inventories Index is considered a positive for future production,” Fiore said. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

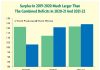

在一段时间内,制造PMI超过43.1%,通常表明整体经济的扩大。因此,12月制造PMI表明2020年4月收缩后连续第19个月的12月增长了整体经济。每年一次,实际国内生产总值(GDP)增加了4.4%。” Fiore说。

The Last 12 Months

| 月 | 制造业 PMI® |

月 | 制造业 PMI® |

|

| Dec 2021 | 58.7 | 2021年6月 | 60.6 | |

| 2021年11月 | 61.1 | May 2021 | 61.2 | |

| Oct 2021 | 60.8 | 2021年4月 | 60.7 | |

| 2021年9月 | 61.1 | Mar 2021 | 64.7 | |

| 2021年8月 | 59.9 | Feb 2021 | 60.8 | |

| Jul 2021 | 59.5 | 2021年1月 | 58.7 | |

| 平均12个月 - 60.7 高 - 64.7 Low – 58.7 |

||||

New Orders

我SM’s New Orders Index registered 60.4 percent in December, a decrease of 1.1 percentage points compared to the 61.5 percent reported in November. This indicates that new orders grew for the 19th consecutive month. “All of the six largest manufacturing sectors — Food, Beverage & Tobacco Products; Petroleum & Coal Products; Chemical Products; Fabricated Metal Products; Transportation Equipment; and Computer & Electronic Products, in that order — expanded at moderate-to-strong levels, up from just three the previous month,” says Fiore. A New Orders Index above 52.8 percent, over time, is generally consistent with an increase in the Census Bureau’s series on manufacturing orders (in constant 2000 dollars).

18个制造行业中有13个报告在12月按以下顺序报告新订单增长:纺织厂;家具和相关产品;电气设备,电器和组件;食品,饮料和烟草产品;杂种制造;石油和煤炭产品;主要金属;机械;化学产品;制造的金属产品; Transportation Equipment; Plastics & Rubber Products; and Computer & Electronic Products. The two industries reporting a decline in new orders in December are: Wood Products; and Paper Products.

| New Orders | %Higher | %Same | %降低 | 网 | 我ndex |

| Dec 2021 | 24.6 | 64.6 | 10.8 | +13.8 | 60.4 |

| 2021年11月 | 23.4 | 66.0 | 10.6 | +12.8 | 61.5 |

| Oct 2021 | 29.7 | 58.3 | 12.0 | +17.7 | 59.8 |

| 2021年9月 | 36.6 | 54.3 | 9.1 | +27.5 | 66.7 |

Production

The Production Index registered 59.2 percent in December, 2.3 percentage points lower than the November reading of 61.5 percent, indicating growth for the 19th consecutive month. “Four of the top six industries — Chemical Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; and Transportation Equipment — expanded at moderate-to-strong levels. Raw material and labor shortages remain a constraint to production growth, as suppliers continue to struggle. Panelist sentiment on labor and material shortages improved for a second month, albeit at a low level,” says Fiore. An index above 52.1 percent, over time, is generally consistent with an increase in the Federal Reserve Board’s Industrial Production figures.

在12月份列出生产增长的10个行业(按顺序列出)是:家具和相关产品;塑料和橡胶产品;纺织厂;纸产品;化学产品;机械;计算机和电子产品;食品,饮料和烟草产品;运输设备;和其他制造。 The four industries reporting a decrease in December are: Apparel, Leather & Allied Products; Wood Products; Fabricated Metal Products; and Primary Metals.

| Production | %Higher | %Same | %降低 | 网 | 我ndex |

| Dec 2021 | 25.6 | 57.0 | 17.4 | +8.2 | 59.2 |

| 2021年11月 | 30.3 | 57.3 | 12.4 | +17.9 | 61.5 |

| Oct 2021 | 31.3 | 54.3 | 14.4 | +16.9 | 59.3 |

| 2021年9月 | 31.6 | 53.1 | 15.3 | +16.3 | 59.4 |

Employment

ISM的就业指数在12月的54.2%中获得了54.2%,比11月份读数为53.3%的0.9个百分点。“该指数报告连续第四个月扩展。在六个大型制造业中,有三个(制造的金属产品;化学产品;计算机和电子产品)扩展了。Survey panelists’ companies are still struggling to meet labor-management plans, but for a fourth month, there were modest signs of progress: A stable share of comments (7 percent in both December and November, compared to 5 percent in October) noted greater hiring ease. An overwhelming majority of panelists indicate their companies are hiring or attempting to hire, as 85 percent of Employment Index comments were hiring focused. Among those respondents, 37 percent expressed difficulty in filling positions, a decrease from November. A high level of comments regarding turnover rates (backfills and retirements) in December continued a trend that began in August,” says Fiore. An Employment Index above 50.6 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

Of 18 manufacturing industries, eight industries reported employment growth in December, in the following order: Apparel, Leather & Allied Products; Nonmetallic Mineral Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Machinery; Fabricated Metal Products; Chemical Products; and Computer & Electronic Products. The five industries reporting a decrease in employment in December are: Textile Mills; Wood Products; Paper Products; Food, Beverage & Tobacco Products; and Miscellaneous Manufacturing.

| Employment | %Higher | %Same | %降低 | 网 | 我ndex |

| Dec 2021 | 15.5 | 72.2 | 12.3 | +3.2 | 54.2 |

| 2021年11月 | 20.5 | 64.6 | 14.9 | +5.6 | 53.3 |

| Oct 2021 | 21.3 | 62.8 | 15.9 | +5.4 | 52.0 |

| 2021年9月 | 17.0 | 65.7 | 17.3 | -0.3 | 50.2 |

供应商Deliveries†

The delivery performance of suppliers to manufacturing organizations was slower in December, as the Supplier Deliveries Index registered 64.9 percent, 7.3 percentage points lower than the 72.2 percent reported in November. Five of the six top manufacturing industries — Fabricated Metal Products; Food, Beverage & Tobacco Products; Computer & Electronic Products; Chemical Products; and Transportation Equipment — reported slowing deliveries. “Deliveries slowed at a slower rate compared to the previous month. The index continues to reflect suppliers’ difficulties in meeting panelist companies’ demand, but for the second straight month, supply chain performance is moving toward a more appropriate balance with demand. Capital expenditure lead times continue at modern-era records. Production materials lead times registered a 5-percent improvement from the prior month but remain at near-record levels. The Supplier Deliveries Index, Prices Index and material lead times softening in November and December indicate progress against the supply/demand imbalance,” says Fiore. A reading below 50 percent indicates faster deliveries, while a reading above 50 percent indicates slower deliveries.

Fourteen of 18 industries reported slower supplier deliveries in December, in the following order: Apparel, Leather & Allied Products; Textile Mills; Nonmetallic Mineral Products; Furniture & Related Products; Miscellaneous Manufacturing; Paper Products; Plastics & Rubber Products; Fabricated Metal Products; Primary Metals; Food, Beverage & Tobacco Products; Machinery; Computer & Electronic Products; Chemical Products; and Transportation Equipment. The two industries reporting faster supplier deliveries in December as compared to November are: Wood Products; and Electrical Equipment, Appliances & Components.

| 供应商Deliveries | %Slower | %Same | %Faster | 网 | 我ndex |

| Dec 2021 | 34.7 | 60.5 | 4.8 | +29.7 | 64.9 |

| 2021年11月 | 48.2 | 48.1 | 3.7 | +44.5 | 72.2 |

| Oct 2021 | 52.5 | 46.1 | 1.4 | +51.1 | 75.6 |

| 2021年9月 | 50.0 | 46.8 | 3.2 | + 46.8 | 73.4 |

库存

The Inventories Index registered 54.7 percent in December, 2.1 percentage points lower than the 56.8 percent reported for November. “Manufacturing inventories continued to expand but at lower levels, as end-of-year working capital targets are likely a cause of softening in the index. Also, the index somewhat reflects an improved flow of raw materials to factories,” says Fiore. An Inventories Index greater than 44.5 percent, over time, is generally consistent with expansion in the Bureau of Economic Analysis (BEA) figures on overall manufacturing inventories (in chained 2000 dollars).

The 10 industries reporting higher inventories in December — in the following order — are: Apparel, Leather & Allied Products; Machinery; Miscellaneous Manufacturing; Chemical Products; Furniture & Related Products; Electrical Equipment, Appliances & Components; Fabricated Metal Products; Plastics & Rubber Products; Transportation Equipment; and Computer & Electronic Products. The four industries reporting a decrease in inventories in December are: Printing & Related Support Activities; Paper Products; Food, Beverage & Tobacco Products; and Primary Metals.

| 库存 | %Higher | %Same | %降低 | 网 | 我ndex |

| Dec 2021 | 21.6 | 61.7 | 16.7 | +4.9 | 54.7 |

| 2021年11月 | 26.2 | 58.1 | 15.7 | +10.5 | 56.8 |

| Oct 2021 | 28.0 | 57.8 | 14.2 | +13.8 | 57.0 |

| 2021年9月 | 29.7 | 51.4 | 18.9 | +10.8 | 55.6 |

客户的库存†

我SM’s Customers’ Inventories Index registered 31.7 percent in December, 6.6 percentage points higher than the 25.1 percent reported for November, indicating that customers’ inventory levels were considered too low. “Customers’ inventories are too low for the 63rd consecutive month, a positive for future production growth. For 17 straight months, the Customers’ Inventories Index has been at historically low levels,” says Fiore.

No industries reported higher customers’ inventories in December. The 14 industries reporting customers’ inventories as too low during December — listed in order — are: Printing & Related Support Activities; Nonmetallic Mineral Products; Textile Mills; Paper Products; Fabricated Metal Products; Machinery; Electrical Equipment, Appliances & Components; Transportation Equipment; Miscellaneous Manufacturing; Computer & Electronic Products; Chemical Products; Wood Products; Furniture & Related Products; and Food, Beverage & Tobacco Products.

| 顾客'库存 | % Reporting | %Too High | %About Right | %Too Low | 网 | 我ndex |

| Dec 2021 | 77 | 8.7 | 46.1 | 45.2 | -36.5 | 31.7 |

| 2021年11月 | 77 | 5.4 | 39.3 | 55.3 | -49.9 | 25.1 |

| Oct 2021 | 78 | 6.7 | 50.1 | 43.2 | -36.5 | 31.7 |

| 2021年9月 | 73 | 11.9 | 39.6 | 48.5 | -36.6 | 31.7 |

价格†

The ISM Prices Index registered 68.2 percent, a decrease of 14.2 percentage points compared to the November reading of 82.4 percent, indicating raw materials prices increased for the 19th consecutive month, at a slower rate in December. This is the 16th month in a row that the index has been above 60 percent. “Aluminum; corrugate and packaging materials; electrical and electronic components; energy; lumber; freight; and some steels continue to remain at elevated prices due to product scarcity amongst high demand,” says Fiore. A Prices Index above 52.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Producer Price Index for Intermediate Materials.

我n December, 16 industries reported paying increased prices for raw materials, in the following order: Apparel, Leather & Allied Products; Textile Mills; Furniture & Related Products; Paper Products; Primary Metals; Miscellaneous Manufacturing; Machinery; Computer & Electronic Products; Chemical Products; Food, Beverage & Tobacco Products; Nonmetallic Mineral Products; Fabricated Metal Products; Transportation Equipment; Wood Products; Electrical Equipment, Appliances & Components; and Plastics & Rubber Products. Only one industry, Petroleum & Coal Products, reported paying decreased prices for raw materials.

| 价格 | %Higher | %Same | %降低 | 网 | 我ndex |

| Dec 2021 | 47.4 | 41.6 | 11.0 | +36.4 | 68.2 |

| 2021年11月 | 67.9 | 29.0 | 3.1 | +64.8 | 82.4 |

| Oct 2021 | 72.3 | 26.7 | 1.0 | +71.3 | 85.7 |

| 2021年9月 | 69.5 | 23.4 | 7.1 | +62.4 | 81.2 |

Backlog of Orders†

ISM积压的订单指数在12月的62.8%中获得了62.8%,比11月份报告的61.9%增加了0.9%,这表明订单的积压是连续第18个月扩大的。这是连续第11个月的读数超过60%。“积压在12月的增长速度略高,表明传入的业务仍然很高。所有六个大型行业(石油和煤炭产品;运输设备;制造的金属产品;化学产品;食品,饮料和烟草产品;以及计算机和电子产品,按此顺序)报告说,积压待遇强烈扩大。” Fiore说。

12月按以下顺序进行积压订单增长的11个行业是:服装,皮革和相关产品;纺织厂;石油和煤炭产品;运输设备;机械;制造的金属产品;化学产品;杂种制造;主要金属;食品,饮料和烟草产品; and Computer & Electronic Products. The only industry reporting lower backlogs in December is Furniture & Related Products. Six industries reported no change in backlogs of orders when comparing December’s levels to November.

| Backlog of Orders | % Reporting | %Higher | %Same | %降低 | 网 | 我ndex |

| Dec 2021 | 90 | 38.0 | 49.7 | 12.3 | +25.7 | 62.8 |

| 2021年11月 | 92 | 35.2 | 53.3 | 11.5 | + 23.7 | 61.9 |

| Oct 2021 | 91 | 36.4 | 54.4 | 9.2 | +27.2 | 63.6 |

| 2021年9月 | 90 | 39.0 | 51.6 | 9.4 | +29.6 | 64.8 |

新出口订单†

ISM的新出口订单指数在12月的53.6%下降了0.4个百分点,而11月份的读数为54%。“新的出口订单指数连续第18个月增长,速度略慢。在六个大型行业中,有四个(食品,饮料和烟草产品;计算机和电子产品;化学产品;运输设备)扩展了。新的出口订单活动是在强大的扩张领域继续进行新订单指数的贡献者。” Fiore说。

六个行业报告了12月的新出口订单增长(按以下顺序)是:塑料和橡胶产品;食品,饮料和烟草产品;计算机和电子产品;杂种制造;化学产品;和运输设备。报告的三个行业在12月的新出口订单下降是:纺织厂;纸产品;和机械。与11月相比,七个行业报告说,12月出口没有变化。

| 新出口订单 | % Reporting | %Higher | %Same | %降低 | 网 | 我ndex |

| Dec 2021 | 75 | 10.8 | 85.5 | 3.7 | +7.1 | 53.6 |

| 2021年11月 | 76 | 11.3 | 85.5 | 3.2 | +8.1 | 54.0 |

| Oct 2021 | 75 | 12.7 | 83.9 | 3.4 | +9.3 | 54.6 |

| 2021年9月 | 75 | 14.1 | 78.6 | 7.3 | +6.8 | 53.4 |

进口†

我SM’s Imports Index registered 53.8 percent in December, an increase of 1.2 percentage points compared to November’s figure of 52.6 percent. “Imports expanded in December for the second consecutive month, in spite of continuing challenges with throughput at U.S. ports of entry. Overland transport challenges and container shortages continue to persist across the global supply chain, causing instability with import-level projections. Imports will continue to be challenged through the first half of 2022,” says Fiore.

The six industries reporting growth in imports in December — in the following order — are: Furniture & Related Products; Petroleum & Coal Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Machinery; and Chemical Products. The five industries reporting a decrease in imports in December are: Nonmetallic Mineral Products; Fabricated Metal Products; Plastics & Rubber Products; Transportation Equipment; and Miscellaneous Manufacturing. Seven industries reported no change in imports in December as compared to November.

| 我mports | % Reporting | %Higher | %Same | %降低 | 网 | 我ndex |

| Dec 2021 | 83 | 17.9 | 71.8 | 10.3 | +7.6 | 53.8 |

| 2021年11月 | 87 | 14.1 | 77.0 | 8.9 | +5.2 | 52.6 |

| Oct 2021 | 86 | 12.5 | 73.3 | 14.2 | -1.7 | 49.1 |

| 2021年9月 | 87 | 20.0 | 69.8 | 10.2 | +9.8 | 54.9 |

†The Supplier Deliveries, Customers’ Inventories, Prices, Backlog of Orders, New Export Orders, and Imports indexes do not meet the accepted criteria for seasonal adjustments.

Buying Policy

12月的资本支出的平均承诺提前时间为161天,比11月相比增加了一天。自2021年1月(141天)以来,在过去12个月中的10个月中的10天,资本支出的交货时间增加了20天。生产材料12月份的平均交货时间减少了五天至91天。与11月相比,维护,维修和运营(MRO)供应的平均销售时间为48天,增加了四天。

| Percent Reporting | |||||||||||

| Capital Expenditures | Hand-to- Mouth | 30天 | 60天 | 90 Days | 6 Months | 1年+ | Average Days | ||||

| Dec 2021 | 21 | 3 | 11 | 11 | 29 | 25 | 161 | ||||

| 2021年11月 | 19 | 4 | 10 | 15 | 27 | 25 | 160 | ||||

| Oct 2021 | 19 | 5 | 9 | 15 | 29 | 23 | 156 | ||||

| 2021年9月 | 20 | 5 | 8 | 15 | 30 | 22 | 154 | ||||

| Percent Reporting | |||||||||||

| Production Materials | Hand-to-Mouth | 30天 | 60天 | 90 Days | 6 Months | 1年+ | Average Days | ||||

| Dec 2021 | 10 | 21 | 24 | 24 | 15 | 6 | 91 | ||||

| 2021年11月 | 10 | 21 | 22 | 26 | 13 | 8 | 96 | ||||

| Oct 2021 | 10 | 19 | 25 | 23 | 16 | 7 | 96 | ||||

| 2021年9月 | 10 | 20 | 29 | 22 | 11 | 8 | 92 | ||||

| Percent Reporting | |||||||||||

| MRO Supplies | Hand-to- Mouth | 30天 | 60天 | 90 Days | 6 Months | 1年+ | Average Days | ||||

| Dec 2021 | 26 | 34 | 21 | 14 | 4 | 1 | 48 | ||||

| 2021年11月 | 29 | 34 | 21 | 12 | 3 | 1 | 44 | ||||

| Oct 2021 | 25 | 35 | 20 | 14 | 5 | 1 | 49 | ||||

| 2021年9月 | 26 | 38 | 20 | 11 | 4 | 1 | 45 | ||||

发表:2022年1月4日

资料来源:美国供应管理协会(ism)